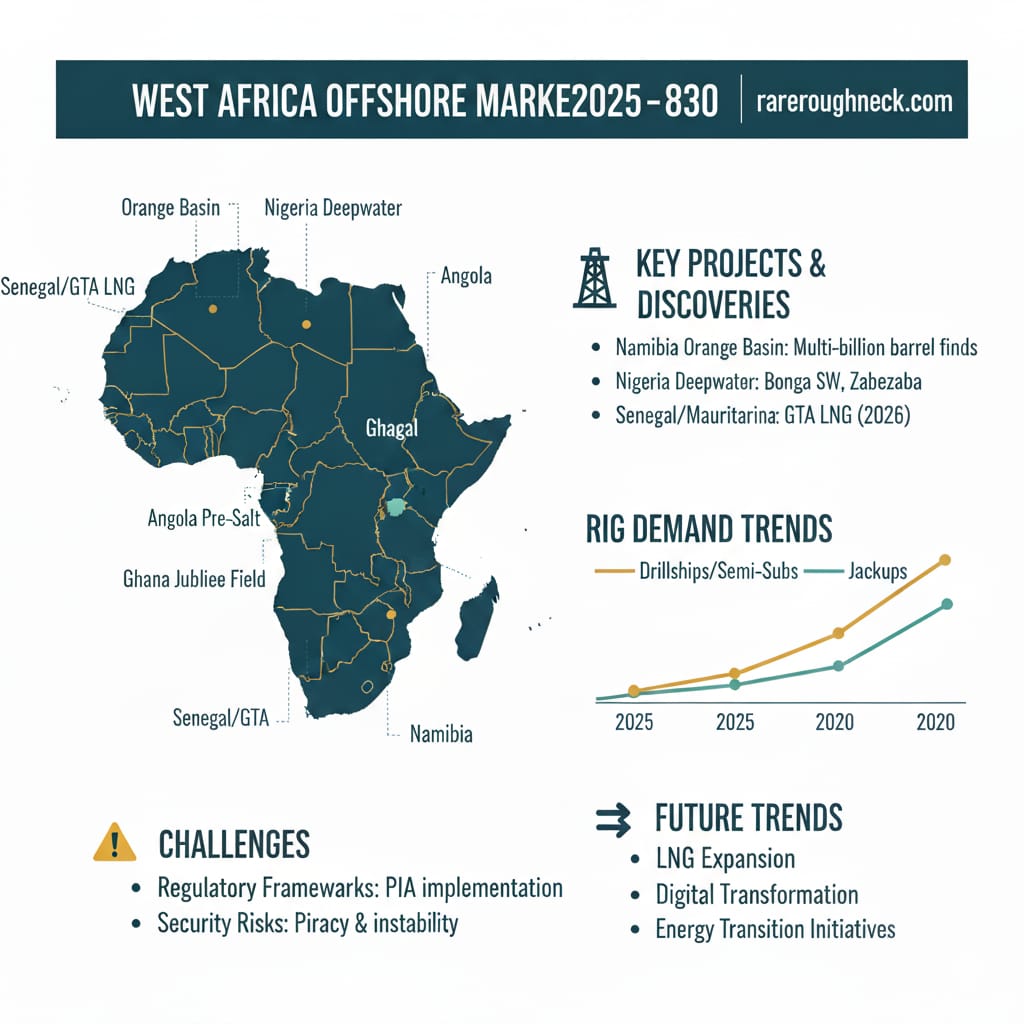

The West Africa offshore oil and gas market outlook 2025–2030 is one of cautious optimism mixed with rapid transformation. Offshore fields account for nearly three-quarters of West Africa’s oil production, and the region is attracting global investment in deepwater exploration, LNG developments, and frontier discoveries.

Countries like Nigeria, Angola, Ghana, Senegal, Ivory Coast, and Namibia are set to shape global energy flows in the coming decade, thanks to major discoveries, expanded LNG capacity, and rising rig demand.

Key Players & Regional Growth Hotspots

- Nigeria – Africa’s largest oil producer, home to deepwater projects such as Bonga Southwest and Zabazaba, both targeting FID in the coming years.

- Angola – Mature but stable, with subsea tiebacks and FPSOs (led by TotalEnergies and Chevron) keeping production steady.

- Ghana – Tullow Oil is boosting output from Jubilee and TEN fields, extending Ghana’s offshore profile.

- Senegal & Mauritania – The Greater Tortue Ahmeyim (GTA) FLNG and Sangomar projects will bring first gas exports by mid-decade.

- Ivory Coast – Eni’s Baleine and Calao discoveries are expected to triple national output by 2027, making it a surprise regional frontrunner.

- Namibia – The Orange Basin is emerging as the next global exploration hotspot, with multi-billion-barrel finds by TotalEnergies and Shell.

West Africa Offshore Rig Demand & Drilling Dynamics

Between 2025 and 2030, rig activity is forecast to expand significantly:

- Deepwater dominance – Drillships and semi-subs remain the backbone of offshore projects in Nigeria and Angola.

- Shallow water stability – Jackup rigs maintain steady demand across Nigeria and Gabon.

- Rig reactivation – Contractors such as Valaris and Noble are bringing older rigs back into service as demand surges.

This rig demand reflects the increasing importance of efficient project execution and cost management across the offshore supply chain.

Major Offshore Discoveries Driving Growth

- Ivory Coast: Baleine & Calao fields, lifting output from 60,000 bpd to 200,000 bpd by 2027.

- Nigeria: Bonga Southwest & Zabazaba deepwater plays approaching FID.

- Senegal/Mauritania: GTA LNG set to export first LNG by 2026.

- Angola: Subsea tiebacks extend the life of aging but strategic fields.

- Namibia: Orange Basin discoveries are transforming regional exploration interest.

Challenges Facing the Offshore Market

Despite strong growth potential, operators must navigate:

- Regulatory Uncertainty – Implementation of Nigeria’s Petroleum Industry Act (PIA) is still under review.

- Security Risks – Piracy and Niger Delta unrest remain operational threats.

- Financing Constraints – Declining Western capital is being replaced by Asian and Middle Eastern investors.

- Energy Transition Pressure – Balancing oil growth with carbon reduction goals is now unavoidable.

Future Trends in West Africa (2025–2030)

- LNG Expansion – Offshore FLNG projects in Senegal and Nigeria will reshape gas exports.

- Subsea Tiebacks – Cost-efficient tiebacks will drive marginal field development.

- Digital Transformation – AI, IoT, and digital twins will optimize offshore operations.

- New Entrants – Ivory Coast and Namibia are joining traditional players, diversifying the energy map.

- Carbon Innovation – Early pilot CCUS projects are being explored in Nigeria and Angola.

Conclusion

The West Africa offshore oil and gas market outlook 2025–2030 reveals a high-reward but high-risk environment. New discoveries, LNG growth, and rig demand will fuel upstream expansion, while challenges in financing, regulation, and security remain hurdles.

For operators, contractors, and investors, West Africa stands out as one of the most dynamic offshore regions worldwide, offering opportunities across deepwater oil, LNG, and new frontier plays.