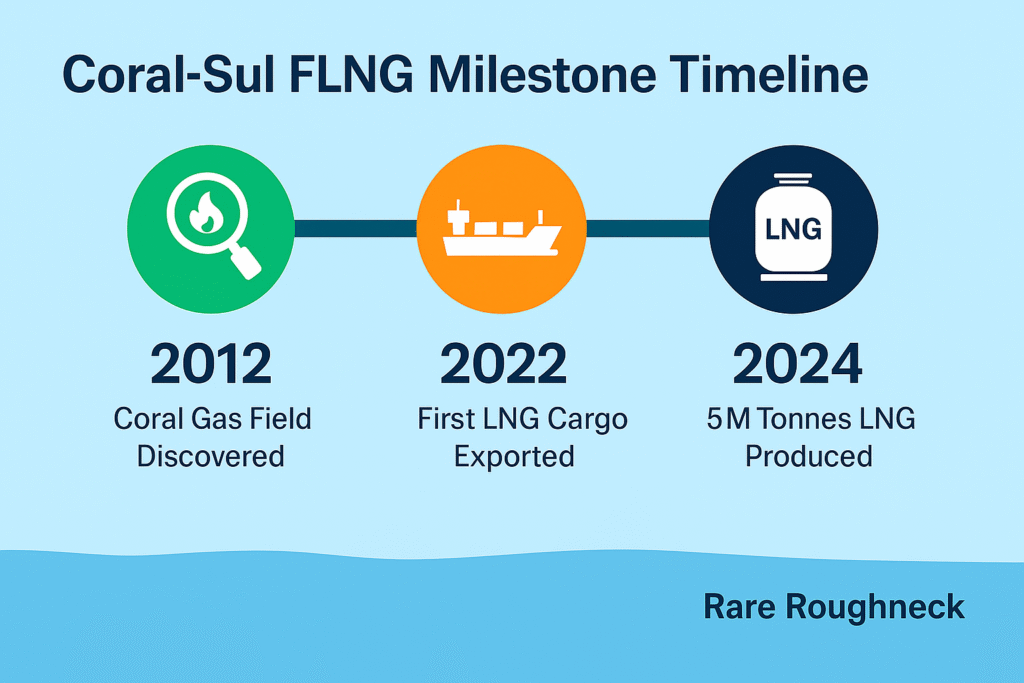

In August 2024, Eni announced that Coral South FLNG (Coral-Sul) had achieved a production milestone of 5 million tonnes of LNG, with 70 cargoes exported since its launch in 2022. This marks not only a major success for Mozambique but also a defining moment for Africa’s energy sector.

Check our other detaile blogs on:

- Floating LNG 2025: The Future of Offshore Gas Production

- Prelude FLNG Largest Floating LNG Platform: Australia’s Offshore Energy Marvel

- Petronas PFLNG Dua Deepwater FLNG: Malaysia’s Offshore LNG Innovation

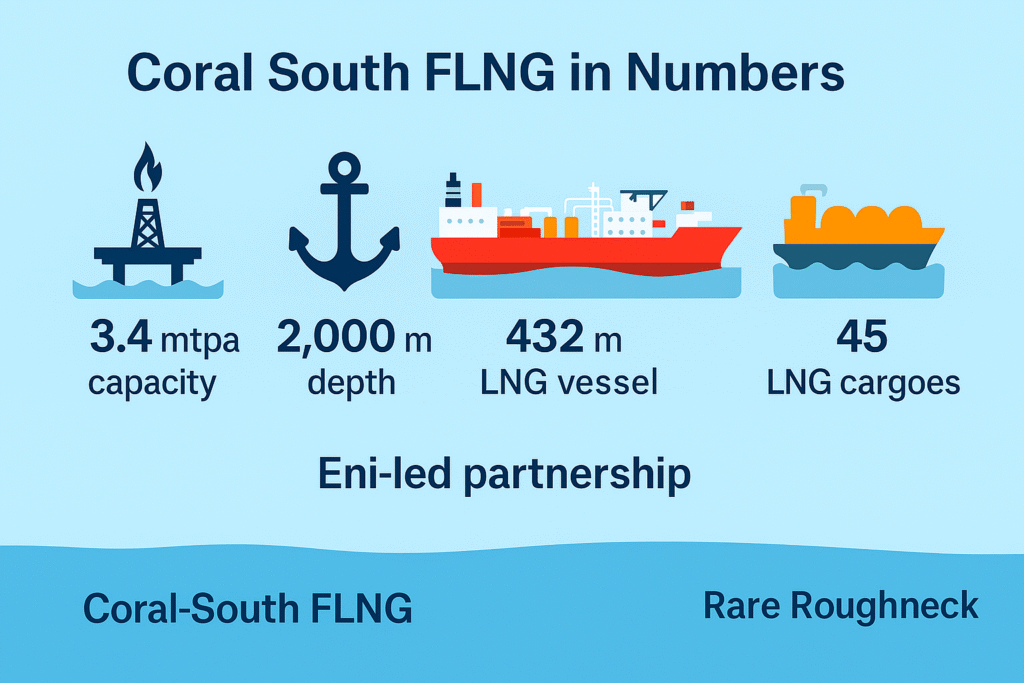

Coral South FLNG in Numbers

- Operator: Eni (on behalf of Rovuma Basin Area 4 partners: ExxonMobil, CNPC, Galp, Kogas, ENH)

- Location: Rovuma Basin, offshore Mozambique

- Water Depth: ~2,000m (ultra-deepwater)

- Capacity: 3.4 million tonnes LNG per year

- Dimensions: 432m long, 66m wide

- Tanks: 8 LNG tanks, total ~228,000 m³ storage

- Production Start: 2022 (first cargo to Europe in Nov 2022)

- Milestone: 5M tonnes LNG produced by Aug 2024

Engineering & Technology Marvel

Coral South FLNG (also called Coral-Sul) is Africa’s first floating LNG facility, designed to unlock Mozambique’s offshore reserves.

- Construction: Built by Samsung Heavy Industries and TechnipFMC.

- Ultra-Deepwater Operation: Works in depths up to 2,000m.

- Energy Efficiency: Uses aero-derivative gas turbines, electric drives, waste heat recovery.

- Capacity: Designed to process ~3.4 Mtpa LNG, ~480 bcm of gas over 25 years.

Achievements of Coral South FLNG

- Africa’s First FLNG: Pioneering project for the continent.

- 5M Tonnes Milestone: Reached within 2 years of start-up.

- 70 LNG Cargoes Exported: Mainly to Europe (Italy, Croatia).

- Boosting Mozambique’s Energy Profile: Positions the country as a new LNG exporter.

- Reserves Access: Unlocks Coral gas field (~10 trillion cubic feet).

Challenges & Risks

- Security Concerns: Cabo Delgado insurgency created delays for other projects in Mozambique.

- High Costs: Coral-Sul cost over $7 billion to develop.

- Market Competition: Qatar, US, and Australia LNG dominate global capacity.

- Infrastructure Dependence: Mozambique’s limited infrastructure could slow further expansion.

Strategic Importance for Mozambique & Beyond

Coral South FLNG is more than a vessel—it’s Mozambique’s entry ticket to the global LNG trade.

- Strengthens Europe’s energy security amid diversification away from Russian gas.

- Adds Africa to the global LNG export map.

- Opens path for future FLNG projects, like Coral Norte (planned 2025–2028, 3.5 Mtpa).

Future Outlook

- Coral Norte FLNG: Approved in 2025, $7.2B investment, set for late 2028 start.

- Coral projects could unlock vast Rovuma Basin reserves.

- Mozambique could emerge as a top 10 LNG exporter by 2030.

Conclusion

The achievement of 5 million tonnes LNG by Coral South FLNG is not just a production milestone—it’s proof that floating LNG can transform emerging economies. For Mozambique, it marks the dawn of a new era in energy exports, and for the world, it demonstrates the scalability of FLNG in ultra-deepwater settings.

Pingback: Floating Carbon Capture (F-CCS) | The Next Offshore Revolution Beyond FLNG